2025 Recap: Top 10 Company Acquisitions in Ophthalmology

The ophthalmology industry in 2025 continued to evolve through strategic acquisitions and partnerships, strengthening innovation pipelines across gene therapy, diagnostics, surgical technology, and digital eye care. From major pharmaceutical companies expanding into emerging markets to device manufacturers advancing AI and regenerative medicine, this year’s deals reflected a focus on precision care, patient accessibility, and scientific advancement.

Below, Ophthalmology Breaking News highlights the Top 10 Company Acquisitions of 2025 that shaped the global eye care landscape.

1. Harrow Acquires U.S. Commercial Rights to Byqlovi

.jpg)

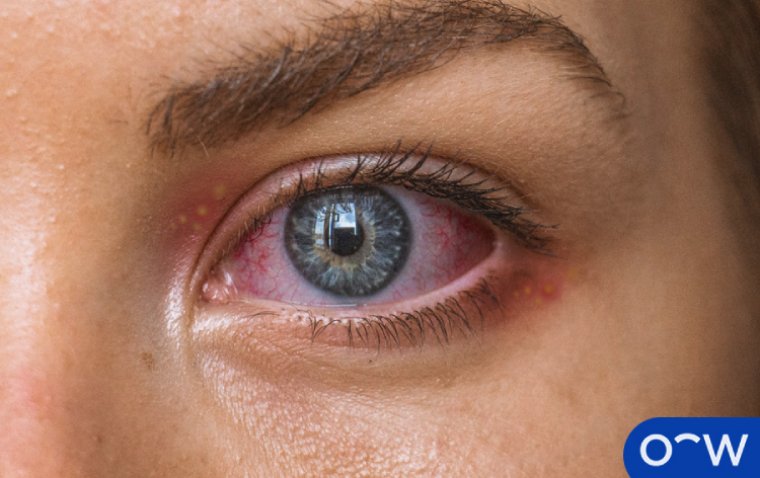

In June 2025, Harrow entered a licensing agreement with Formosa Pharmaceuticals to acquire exclusive U.S. commercial rights to Byqlovi (clobetasol propionate ophthalmic suspension) 0.05%, a treatment for postoperative inflammation and pain following ocular surgery. Approved by the FDA in March 2024, Byqlovi is the first new ophthalmic steroid in its class in over 15 years.

Developed using Formosa’s Advanced Particle Nanotechnology (APNT), the formulation ensures consistent dosing and strong efficacy, with clinical data showing rapid pain relief and a low rate of elevated intraocular pressure (1.4%). Harrow plans to launch Byqlovi in Q4 2025, targeting a U.S. market of more than seven million surgeries annually.

2. Topcon Healthcare Acquires RetInSight to Advance AI Retinal Imaging

.jpg)

Topcon Healthcare announced the acquisition of RetInSight, an Austria-based AI company specializing in OCT image analysis. The deal supports Topcon’s goal of integrating AI into ophthalmic diagnostics to improve early detection and monitoring of diseases such as AMD, DME, RVO, and geographic atrophy.

RetInSight’s algorithms originated from research at the Medical University of Vienna and are already commercialized across Europe. Both companies emphasized that the acquisition would enhance global access to AI-driven diagnostic tools, support clinical decision-making, and contribute to regulatory progress in AI-assisted retinal disease management.

3. Alcon Acquires Majority Stake in Aurion Biotech

.jpg)

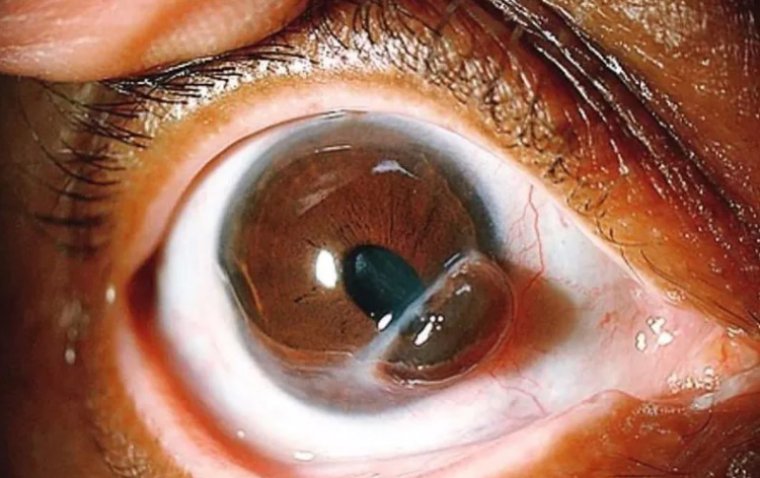

Alcon expanded its regenerative medicine portfolio by acquiring a majority stake in Aurion Biotech, a company developing cell therapies for corneal endothelial disease. Aurion will continue operating independently while advancing its lead candidate, AURN001, an allogeneic cell therapy that has received both Breakthrough Therapy and RMAT Designations from the FDA.

Aurion recently completed its Phase 1/2 CLARA trial and is preparing for Phase 3 in late 2025. The acquisition follows Alcon’s announced plans to acquire Lensar, reinforcing its strategy to broaden its innovation pipeline from surgical devices to regenerative therapeutics.

4. EssilorLuxottica Acquires Cellview Imaging to Strengthen Diagnostic Capabilities

.jpg)

EssilorLuxottica completed its acquisition of Cellview Imaging, a Toronto-based med-tech startup focused on advanced retinal imaging. Cellview’s ultra-widefield technology captures broader retinal images than most existing systems and is already FDA- and CE-mark approved.

The acquisition expands EssilorLuxottica’s med-tech division and supports its goal of improving early detection of retinal pathologies. The company plans to extend Cellview’s global reach, beginning with European markets, as part of its long-term strategy to strengthen its position in vision health diagnostics.

5. McKesson Acquires Controlling Interest in PRISM Vision Holdings

.jpg)

McKesson Corporation acquired an 80% controlling interest in PRISM Vision Holdings, a leading retina and ophthalmology management services provider, for approximately $850 million. The move marks McKesson’s entry into ophthalmology and retina care, expanding its specialty healthcare portfolio.

PRISM Vision operates across 91 offices and seven surgery centers with over 180 providers. The acquisition strengthens McKesson’s U.S. Pharmaceutical segment, aligning with its strategy to enhance access to community-based specialty care and support innovation in retinal disease management.

6. Regeneron Acquires UK-Based Oxular to Advance Retinal Drug Delivery

.jpg)

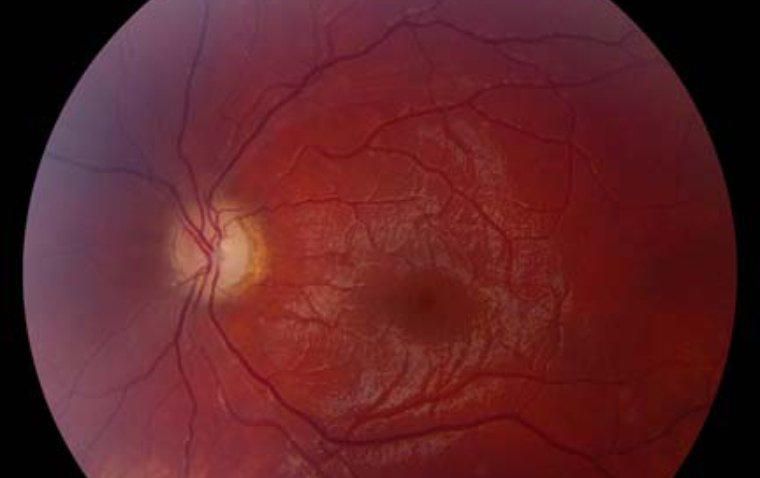

Regeneron acquired Oxular, a UK-based clinical-stage biotech company focused on ocular drug delivery for retinal diseases. Oxular’s lead therapy, OXU-001, is a dexamethasone-based formulation utilizing its proprietary Oxuspheres and Oxulumis technologies for targeted, sustained drug delivery to the posterior eye.

The acquisition gives Regeneron access to Oxular’s suprachoroidal delivery platform, supporting long-acting treatments for diabetic macular edema (DME) and other retinal disorders. OXU-001 is currently being evaluated in the Phase 2 OXEYE trial, with potential to extend treatment durability to one year.

7. Zeiss Vision Care Acquires Stake in Ocumeda to Advance Tele-Ophthalmology

.jpg)

Zeiss Vision Care acquired a 10% stake in Ocumeda AG, a digital tele-ophthalmology platform, for €10 million, with the option to increase its ownership to 25%. The investment aims to enhance access to primary eye care through digital collaboration between optometrists, ophthalmologists, and optical professionals.

The partnership aligns with Zeiss’s strategy to expand digital vision care and supports Fielmann Group’s Vision 2035 digital health goals. The companies plan to scale Ocumeda’s tele-ophthalmology platform across Europe, promoting early intervention and remote care accessibility.

8. Lupin Acquires VISUfarma to Strengthen European Ophthalmology Presence

.jpg)

Lupin Limited acquired VISUfarma, a European specialty pharmaceutical company focused on ophthalmology, from GHO Capital Partners. The acquisition expands Lupin’s specialty presence in Europe, adding a portfolio of over 60 ophthalmic products covering dry eye disease, glaucoma, blepharitis, and retinal health.

Through its subsidiary Nanomi BV, Lupin gains access to established European markets and infrastructure to support continued growth. The deal reinforces Lupin’s commitment to developing innovative eye care solutions and strengthening its global specialty pharmaceutical business.

9. PainReform Acquires Majority Equity Interest in LayerBio

.jpg)

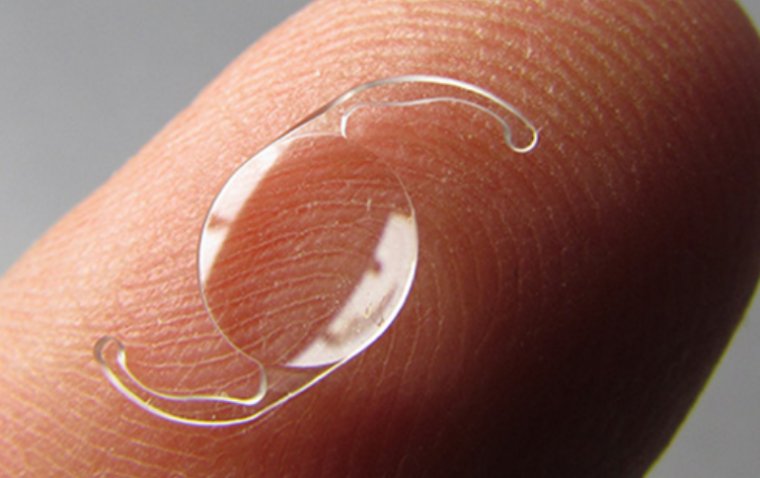

PainReform acquired a majority stake in LayerBio, gaining access to its OcuRing-K sustained-release implant technology for use in cataract surgery. The device attaches to the intraocular lens (IOL) haptic and delivers medications, such as ketorolac, directly within the eye to prevent postoperative complications.

This “dropless” approach aims to simplify postoperative care, reducing dependence on eye drops and improving compliance. The OcuRing platform may also support future applications in glaucoma, corneal transplantation, and anti-infective treatments.

10. Eli Lilly Acquires Rights to MeiraGTx’s Gene Therapy for LCA4

.jpg)

Eli Lilly and Company acquired worldwide rights to AAV-AIPL1, an investigational gene therapy for Leber congenital amaurosis type 4 (LCA4), from MeiraGTx. The agreement includes a $75 million upfront payment, potential $400 million in milestones, and tiered royalties on future sales.

Early clinical data in children with LCA4 showed measurable vision improvements and enhanced social and cognitive development. The acquisition also gives Lilly access to MeiraGTx’s gene therapy platform, including novel intravitreal capsids and riboswitch technology that enables precise control of therapeutic protein expression.

Conclusion: A Year of Strategic Expansion and Innovation

The ophthalmology sector in 2025 was defined by strategic acquisitions that bridged technology, therapeutics, and digital care. From AI-driven diagnostics and gene therapy breakthroughs to tele-ophthalmology and regenerative medicine, companies across the industry strengthened their pipelines and global footprints.

As these integrations progress, the coming years are expected to bring expanded treatment access, new clinical collaborations, and continued innovation across the full spectrum of eye care.

(1).jpg)