2024 Recap: Top 10 Company Acquisitions in the Ophthalmic Industry

In 2024, the ophthalmic industry experienced a transformative year driven by strategic company acquisitions, paving the way for groundbreaking advancements and innovative collaborations. The year’s top 10 acquisitions underscored a significant shift in the sector's competitive landscape.

Here are the top 10 notable acquisitions that have reshaped the industry landscape:

1. Merck Completes Acquisition of EyeBio

.jpg)

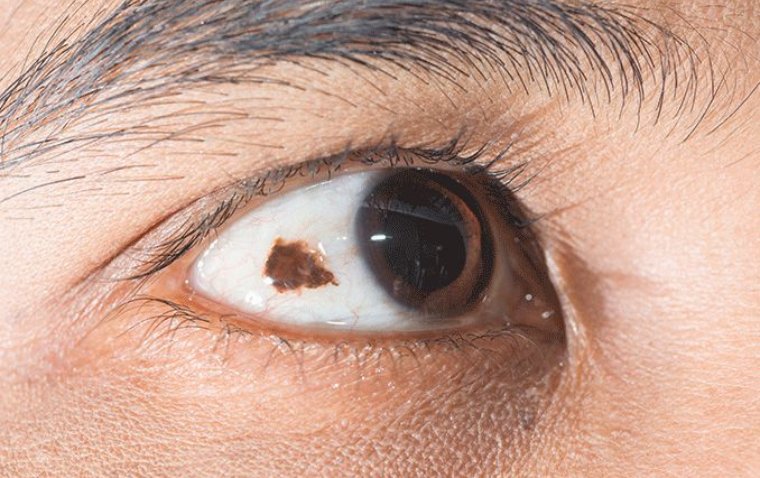

In July 2024, Merck, known as MSD outside of the United States and Canada announced the completion of the acquisition of Eyebiotech Limited (EyeBio). Accordingly, Merck, through a subsidiary, has acquired all outstanding shares of EyeBio. Within the scope of the transaction, which is classified as an asset acquisition, Merck will record a charge of approximately $1.3 billion, or approximately $0.50 per share in the third quarter of 2024, which will be included in non-GAAP results.

Merck’s enhanced pipeline now features additional clinical and preclinical assets aimed at tackling vision loss caused by retinal vascular leakage, a key contributor to numerous retinal diseases.

Click here to learn more about the transaction.

2. Carl Zeiss Meditec Completes Acquisition of Dutch Ophthalmic Research Center

.jpg)

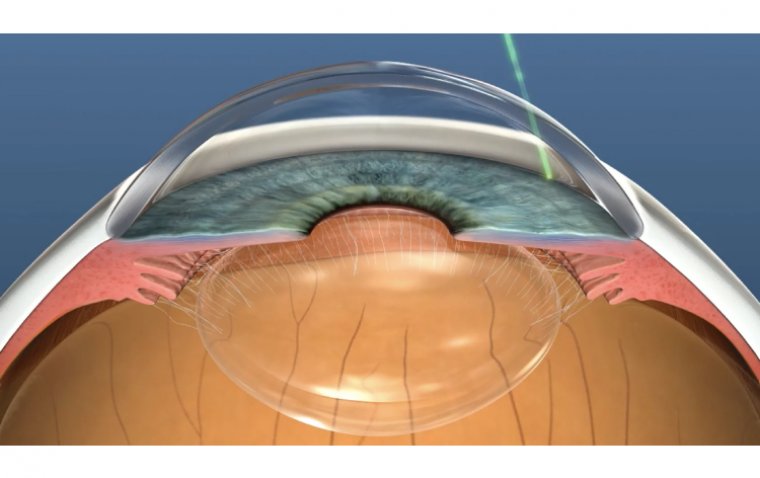

Carl Zeiss Meditec AG revealed that it has completed the acquisition of 100% of D.O.R.C. (Dutch Ophthalmic Research Center) from the investment firm Eurazeo SE, Paris, France with a total worth of €985 million (nearly $1.09 billion). With this move, the company is aiming to enhance Zeiss's position in the ophthalmic surgery market by integrating D.O.R.C.'s innovative solutions.

This acquisition is expected to significantly enhance ZEISS Medical Technology’s already extensive ophthalmic portfolio, offering a comprehensive range of digitally connected workflow solutions. By integrating D.O.R.C. into Carl Zeiss Meditec AG’s offerings, the company aims to address a wide spectrum of eye conditions, including retinal disorders, cataracts, glaucoma, and refractive errors.

A standout feature of this acquisition is the inclusion of the EVA NEXUSTM platform, recognized as one of the most advanced dual-function systems on the market. Serving as the cornerstone of an exceptional portfolio, the EVA NEXUSTM platform combines dual-capability with an array of accessories, instruments, and liquids. This versatile system is designed to excel in vitreoretinal (VR), cataract, and combined surgeries, enabling surgeons to handle a variety of procedures with a single platform. The result is streamlined workflows and enhanced efficiency for ophthalmic practices.

Learn more about the acquisition.

3. EssilorLuxottica Acquires 80% Stake in Heidelberg Engineering

.jpg)

EssilorLuxottica has acquired an 80% stake in Heidelberg Engineering, a leading German company specializing in advanced ophthalmic technology. While the financial details of the transaction remain undisclosed, the move underscores EssilorLuxottica’s commitment to integrating cutting-edge medical technologies into its portfolio.

Founded in 1990 by Dr. Gerhard Zinser and Christoph Schoess, Heidelberg Engineering is renowned for its expertise in optical coherence tomography (OCT), real-time image processing, analytics, and digital surgical navigation. Despite the acquisition, the company will maintain its independence and continue operating under its existing brand within the EssilorLuxottica group.

This acquisition represents a pivotal step in the convergence of optical and medical technologies, paving the way for global advancements in eye care solutions.

4. ANI Pharmaceuticals Acquires Alimera Sciences

.jpg)

ANI Pharmaceuticals Inc. has announced the successful completion of its previously disclosed acquisition of Alimera Sciences Inc.

Key Details of the Acquisition

• Transaction Terms: ANI acquired all outstanding shares of Alimera at a price of $5.50 per share.

• Debt Repayment: As part of the agreement, ANI also repaid $72.5 million of Alimera’s outstanding debt.

• Contingent Value Rights (CVR): Alimera investors received one non-tradable CVR per share, granting the right to receive up to an additional $0.50 per share, contingent on the achievement of specified net revenue targets in 2026 and 2027.

This acquisition marks a significant step for ANI Pharmaceuticals as it integrates Alimera Sciences into its operations, with a focus on strategic growth and expanded offerings.

5. Sandoz Finalizes Acquisition of Biosimilar Cimerli from Coherus BioSciences

.jpg)

Sandoz has officially completed its acquisition of Cimerli (ranibizumab-eqrn), a biosimilar in the United States, from Coherus BioSciences. This strategic acquisition highlights Sandoz’s dedication to expanding its presence in the biopharmaceutical sector, particularly in the rapidly growing field of biosimilars.

Initially announced in January 2024, the transaction aligns with Coherus BioSciences’ strategy to reduce debt and refocus on its core oncology business. Sandoz acquired the Cimerli ophthalmology franchise for a total consideration of $170 million in cash, along with costs related to Cimerli inventory.

The acquisition package includes:

• The biologics license application (BLA) for Cimerli.

• Coherus’ ophthalmology sales and select field reimbursement teams.

• Existing product inventory.

• Access to proprietary commercial software.

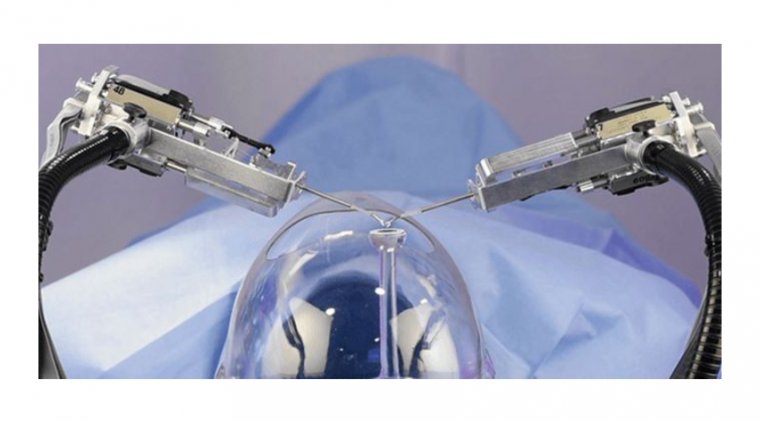

6. Alcon Completes Acquisition of BELKIN Vision

.jpg)

Alcon has announced the completion of its acquisition of BELKIN Vision. The deal includes a total upfront consideration of $81 million, comprising a cash payment of approximately $65 million, with the potential for up to $385 million in milestone-based payments tied to rigorous sales benchmarks.

This acquisition brings BELKIN Vision’s Direct Selective Laser Trabeculoplasty (DSLT) technology into Alcon’s glaucoma portfolio, strengthening its position with an innovative first-line therapy. Alcon’s existing glaucoma offerings include the Hydrus® Microstent and pharmaceutical eye drops available in the U.S., complementing the newly acquired technology.

BELKIN Vision received FDA 510(k) clearance in December for its Eagle device, a Q-switched, 532 nm-wavelength, frequency-doubled Nd:YAG laser designed for Selective Laser Trabeculoplasty (SLT). The Eagle is marketed as the first and only contactless laser for glaucoma treatment, providing a fully automated and noninvasive option that enhances convenience for both patients and healthcare providers.

This acquisition underscores Alcon’s commitment to expanding its glaucoma treatment portfolio with cutting-edge solutions to improve outcomes and accessibility for patients worldwide.

7. Clínica Baviera Acquires UK-Based Optimax Group for €11.7 Million

.jpg)

Clínica Baviera, through its subsidiary Castellana Intermediación Sanitaria, S.L., has finalized an agreement to acquire 100% of the share capital of Optimax (Eye Hospitals Group Limited and its subsidiaries). This acquisition strategically positions Clínica Baviera within the UK market, complementing its established operations in Spain, Germany, and Italy.

The UK expansion is significant, given the country's population of over 68 million, and aligns with Clínica Baviera’s broader growth strategy. The acquisition deal is valued at €11.7 million, which will be financed through the company’s own funds. Additionally, a variable acquisition amount tied to Optimax’s EBITDA performance over the next five years has been agreed upon, with an estimated range of €3 to €11 million.

The transaction is pending approval from the Financial Conduct Authority (FCA) due to the change in control of the Optimax Group. A deadline of six months has been set to fulfill this regulatory condition.

This acquisition marks a milestone in Clínica Baviera’s expansion, strengthening its presence in Europe and advancing its position in the ophthalmic care market.

8. Bausch + Lomb Acquires Trukera Medical to Enhance Surgical Capabilities

.jpg)

Bausch + Lomb has announced the completion of its acquisition of Trukera Medical, a U.S.-based company specializing in ophthalmic medical diagnostics. While the financial terms of the transaction remain undisclosed, the acquisition strengthens Bausch + Lomb’s presence in the surgical sector in the United States and expands its portfolio in dry eye management.

A key component of this acquisition is Trukera’s ScoutPro diagnostic technology, which plays a critical role in detecting hyperosmolarity—a condition often overlooked during slit lamp examinations. Hyperosmolarity is a significant marker and primary cause of asymptomatic dry eye disease (DED) and ocular surface disease (OSD).

Addressing hyperosmolarity is crucial for optimizing outcomes in corneal, cataract, and refractive surgeries, as untreated OSD can adversely affect surgical success. This acquisition positions Bausch + Lomb to provide more comprehensive solutions for eye care professionals and their patients.

Learn more about the acquisition.

9. Sightpath Medical Acquires LASIK Services Provider, PennVista

.jpg)

Sightpath Medical, a leading provider of mobile and fixed ophthalmic surgical services, has announced the acquisition of PennVista, a prominent LASIK services provider. PennVista is known for delivering advanced LASIK equipment and highly trained technicians to surgery centers and hospitals in Pennsylvania, Ohio, West Virginia, Indiana, and Michigan.

While the financial terms of the deal have not been disclosed, the acquisition represents a strategic move for Sightpath Medical to enhance its support for ophthalmology practices. This development underscores Sightpath Medical’s commitment to advancing ophthalmic care and providing top-tier services to its partners and patients.

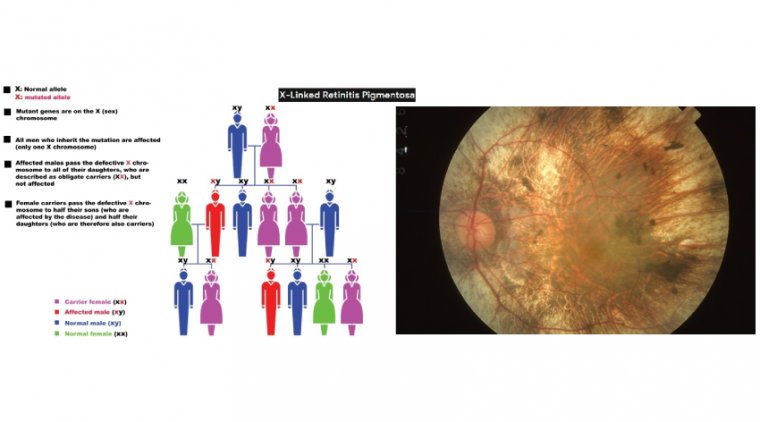

10. Cencora Expands Specialty Care Leadership with Acquisition of Retina Consultants of America

.jpg)

Cencora has announced a definitive agreement to acquire Retina Consultants of America (RCA), a leading management services organization (MSO) specializing in retina care, from Webster Equity Partners. This acquisition aligns with Cencora’s strategy to expand its presence in specialty healthcare and strengthen support for community providers in the rapidly growing retinal care sector.

Within the scope of the agreement, Cencora will acquire RCA for approximately $4.6 billion in cash, subject to standard working capital and net-debt adjustments. RCA’s affiliated practices, physicians, and management will retain a minority stake, with Cencora holding approximately 85% ownership upon closing. An additional $500 million in contingent consideration may be paid in fiscal years 2027 and 2028, contingent upon achieving specific business objectives.

This acquisition reinforces Cencora’s commitment to leading specialty healthcare, driving innovative research, and improving patient outcomes in the field of retinal care. The transaction is expected to close following regulatory approvals and customary closing conditions, marking a pivotal step in Cencora’s growth and dedication to advancing care in this high-growth sector.

Shaping the Future of Ophthalmology

The top 10 acquisitions underscore the ophthalmic industry's dedication to driving innovation, fostering collaboration, and meeting the ever-changing needs of patients globally. By uniting their expertise and resources, key players are paving the way for a new era of advancements in ophthalmic research, development, and patient care.

(1).jpg)