Merck Completes Acquisition of EyeBio

Merck, known as MSD outside of the United States and Canada, announced the successful completion of its acquisition of Eyebiotech Limited (EyeBio), marking EyeBio as a fully owned subsidiary of Merck.

“The EyeBio acquisition further diversifies our late-stage pipeline with the addition of a promising candidate based on novel biology and genetics for the treatment of certain retinal diseases,” stated Dr. Dean Y. Li, President of Merck Research Laboratories. “We are excited to welcome the EyeBio team and look forward to working together to advance Restoret for the patients that need it.”

Introducing Restoret™ and Advancing Retinal Disease Treatments

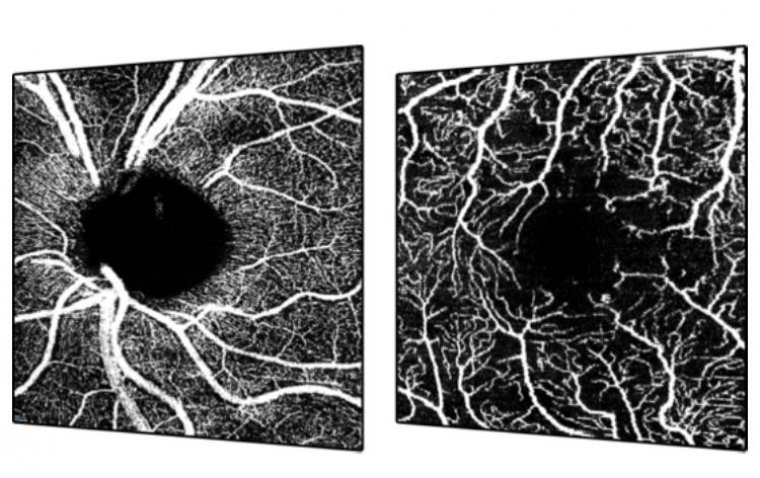

EyeBio’s lead candidate, Restoret™ (EYE103), represents an investigational, potentially groundbreaking tetravalent, tri-specific antibody that functions as an agonist of the Wingless-related integration site (Wnt) signaling pathway. Following encouraging outcomes from the open-label Phase 1b/2a AMARONE study in patients with diabetic macular edema (DME) and neovascular age-related macular degeneration (NVAMD), Restoret is slated to progress into a pivotal Phase 2b/3 trial aimed at evaluating its efficacy in treating DME patients in the latter half of 2024.

Merck’s expanded pipeline now includes additional clinical and preclinical assets dedicated to addressing vision loss associated with retinal vascular leakage, a critical factor in various retinal diseases.

Transaction Details

Under the terms of the agreement, Merck, through a subsidiary, has acquired all outstanding shares of EyeBio. The transaction, classified as an asset acquisition, entails Merck recording an approximate charge of $1.3 billion, or roughly $0.50 per share, in the third quarter of 2024. This charge will be reflected in non-GAAP results. Merck plans to update its financial outlook for the full year after reporting second-quarter 2024 results on July 30, adhering to its quarterly update policy.

(1).jpg)