2023 Recap: Top 10 Company Acquisitions in the Ophthalmic Industry

Top 10 Company Acquisitions in the Ophthalmic Industry.

In 2023, the ophthalmic industry witnessed a transformative landscape shaped by strategic company acquisitions, setting the stage for significant advancements and collaborations. The top 10 acquisitions of the year highlighted a dynamic shift in the competitive dynamics of the sector.

Here are the top 10 acquisitions that have recently made headlines, showcasing the dynamic evolution of key players in the field.

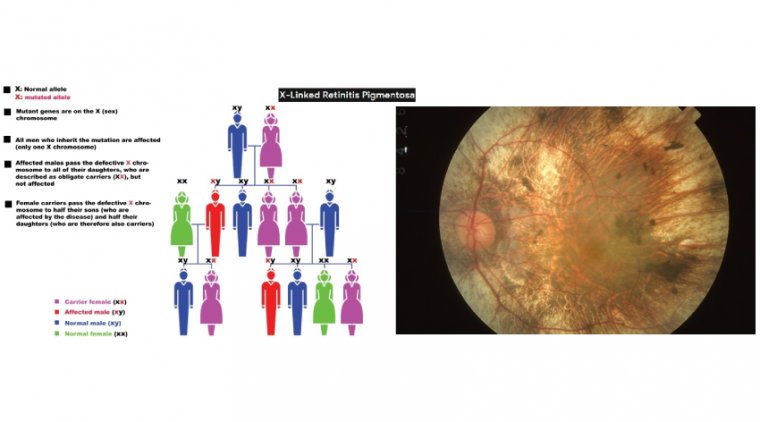

1. Amgen to Acquire Horizon Therapeutics in a $27.8 Billion Deal

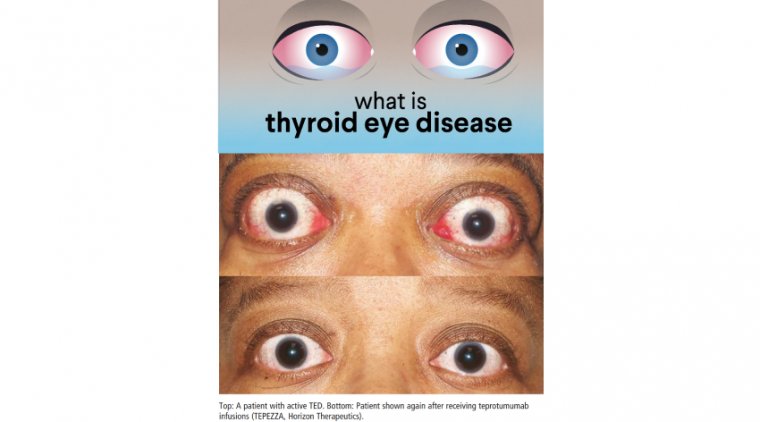

The agreed-upon terms between Amgen and the FTC come with specific provisions aimed at maintaining a competitive and fair market. Notably, Amgen will be subject to prohibitions, including restrictions on bundling its own products with those of Horizon Therapeutics.

This is particularly pertinent to key therapies such as teprotumumab-trbw (Tepezza) for thyroid eye disease and pegloticase (Kyrtexxa) for gout treatment. The FTC's stipulations also expressly prohibit Amgen from tying any product rebates or contract terms associated with its products to the promotion, sale, or positioning of these two critical drugs in Horizon's portfolio, underscoring the regulator's commitment to ensuring a level playing field in the pharmaceutical industry.

Click here to learn more about the Amgen-Horizon Therapeutics deal.

2. Astellas Pharma's $5.9 Billion Acquisition of Iveric Bio

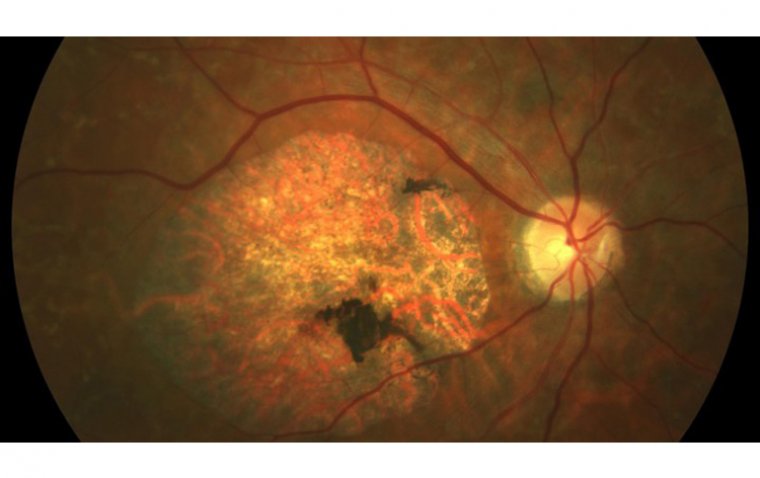

.jpg) Astellas Pharma has made a significant move in the industry with the announcement of its acquisition of Iveric Bio, a pharmaceutical firm at an advanced stage of developing a drug for geographic atrophy. The acquisition, valued at an impressive $5.9 billion, underscores Astellas Pharma's strategic focus on expanding its portfolio and capabilities in addressing critical medical needs, particularly in the field of ophthalmology.

Astellas Pharma has made a significant move in the industry with the announcement of its acquisition of Iveric Bio, a pharmaceutical firm at an advanced stage of developing a drug for geographic atrophy. The acquisition, valued at an impressive $5.9 billion, underscores Astellas Pharma's strategic focus on expanding its portfolio and capabilities in addressing critical medical needs, particularly in the field of ophthalmology.

Under the terms of this substantial agreement, Astellas US Holding's wholly-owned subsidiary, Berry Merger Sub Inc., is set to acquire all outstanding shares of Iveric Bio for a substantial $40 per share in cash. This offering represents a notable 22% premium to Iveric's closing price on April 28th, emphasizing the perceived value and potential of Iveric Bio's late-stage geographic atrophy drug. To finance this acquisition, Astellas Pharma plans to utilize a combination of debt and cash, showcasing the company's commitment to strategically investing in cutting-edge medical research and development for the benefit of patients worldwide.

Click here to learn more about the Astellas Pharma-Iveric Bio deal.

3. Bausch & Lomb Expands Reach with Acufocus Acquisition

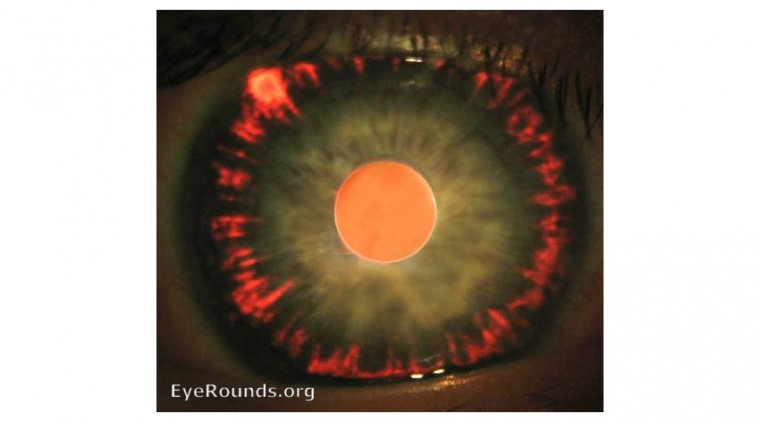

.jpg) Bausch + Lomb has announced its strategic plans to acquire AcuFocus, the manufacturer of the IC-8 Apthera Intraocular Lens (IOL). The acquisition will be facilitated through an affiliate of Bausch + Lomb, which is set to merge with the parent company of AcuFocus in a comprehensive transaction. While the financial terms of the deal remain undisclosed, this move is anticipated to significantly enhance Bausch + Lomb's cataract surgical portfolio.

Bausch + Lomb has announced its strategic plans to acquire AcuFocus, the manufacturer of the IC-8 Apthera Intraocular Lens (IOL). The acquisition will be facilitated through an affiliate of Bausch + Lomb, which is set to merge with the parent company of AcuFocus in a comprehensive transaction. While the financial terms of the deal remain undisclosed, this move is anticipated to significantly enhance Bausch + Lomb's cataract surgical portfolio.

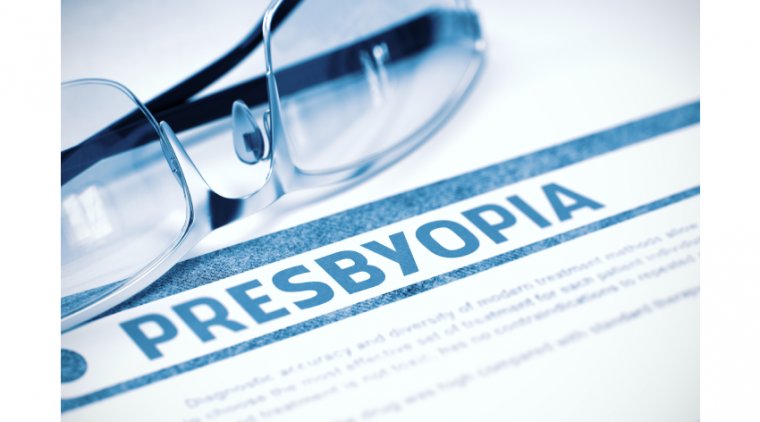

The focal point of this acquisition lies in the FDA-approved IC-8, a groundbreaking small aperture non-toric extended depth of focus IOL developed by AcuFocus. This lens, approved by the FDA in July 2022, holds the distinction of being the first and only of its kind for cataract patients with up to 1.5 diopters of corneal astigmatism who also seek a solution for presbyopia.

Click here to learn more about the Bausch + Lomb-AcuFocus deal.

4. Zeiss Signs $1 Billion Deal to Acquire DORC

.jpg) Carl Zeiss Meditec AG has recently revealed a major strategic move with the announcement of its agreement to acquire 100% of the shares in D.O.R.C. Dutch Ophthalmic Research Center (International) B.V. from Eurazeo SE, headquartered in Paris, France. Valued at €985 million (approximately $1.09 billion), this significant acquisition is poised to bring transformative advancements to ZEISS Medical Technology's extensive ophthalmic portfolio.

Carl Zeiss Meditec AG has recently revealed a major strategic move with the announcement of its agreement to acquire 100% of the shares in D.O.R.C. Dutch Ophthalmic Research Center (International) B.V. from Eurazeo SE, headquartered in Paris, France. Valued at €985 million (approximately $1.09 billion), this significant acquisition is poised to bring transformative advancements to ZEISS Medical Technology's extensive ophthalmic portfolio.

This strategic integration of D.O.R.C. into Carl Zeiss Meditec AG's offerings aims to provide a holistic suite of digitally connected workflow solutions in the field of medical technology. The comprehensive portfolio resulting from this acquisition is expected to play a pivotal role in addressing a broad spectrum of eye conditions, including retinal disorders, cataracts, glaucoma, and refractive errors.

Click here to learn more about the Zeiss-DORC deal.

5. BVI Acquires Medical Mix, Expanding its Footprint in Portugal and Spain

.jpg) BVI has recently made a strategic advancement in its growth trajectory with the acquisition of Medical Mix, a specialized medical devices company focused on ophthalmic surgery in Spain and Portugal. BVI now offers a complete range of products designed for the treatment of various ocular conditions, including cataracts, retinal disorders, and glaucoma, solidifying its position as a key player in the ophthalmic industry.

BVI has recently made a strategic advancement in its growth trajectory with the acquisition of Medical Mix, a specialized medical devices company focused on ophthalmic surgery in Spain and Portugal. BVI now offers a complete range of products designed for the treatment of various ocular conditions, including cataracts, retinal disorders, and glaucoma, solidifying its position as a key player in the ophthalmic industry.

This acquisition stands as a testament to BVI's ongoing journey of expansion and transformation, a journey that has been gaining momentum since 2018. With established direct sales representatives and a robust infrastructure, BVI has successfully broadened its European footprint to include all major western European markets. This remarkable expansion represents a noteworthy achievement, especially when compared to the company's presence in just three markets five years ago.

6. Amring Completes Acquisition of Visant Medical

.jpg) Amring Pharmaceuticals Inc., a subsidiary of Nordic Group B.V., has successfully completed its acquisition of Visant Medical, Inc., positioning itself as a major player in medical technology for Dry Eye Disease (DED).

Amring Pharmaceuticals Inc., a subsidiary of Nordic Group B.V., has successfully completed its acquisition of Visant Medical, Inc., positioning itself as a major player in medical technology for Dry Eye Disease (DED).

Nordic Pharma is poised to capitalize on this acquisition by launching and commercializing LACRIFILL in the United States, a decision reflecting the company's steadfast commitment to advancing ophthalmology. The acquisition not only underscores Nordic Pharma's dedication to the global ophthalmology market but also heralds the introduction of LACRIFILL as a patented therapy for DED in the United States.

7. TFS HealthScience Acquires AppleTree CI Group

.jpg) In a notable development within the contract research organization (CRO) landscape, TFS HealthScience has successfully acquired Appletree CI Group, a CRO and global regulatory affairs service provider.

In a notable development within the contract research organization (CRO) landscape, TFS HealthScience has successfully acquired Appletree CI Group, a CRO and global regulatory affairs service provider.

This collaboration extends the global reach for clients of both TFS HealthScience and Appletree CI Group, offering a broader spectrum of expertise and resources in the realm of clinical research and regulatory affairs. Notably, the acquisition is set to significantly bolster TFS HealthScience's presence and proficiency in key disciplines such as pediatric research, medical devices, dermatology, and ophthalmology.

Click here to learn more about the TFS Healthcare-Appletree CI Group.

8. HCP CureBlindness Takes Over SightLife International

.jpg) HCP Cureblindness announced the acquisition of SightLife International, the global division of the SightLife organization, marking a significant consolidation within the eye health nonprofit sector. Over the next 12 months, the integration of systems, programs, and branding is set to unfold, solidifying the merger of these two entities with a shared mission of combating blindness globally.

HCP Cureblindness announced the acquisition of SightLife International, the global division of the SightLife organization, marking a significant consolidation within the eye health nonprofit sector. Over the next 12 months, the integration of systems, programs, and branding is set to unfold, solidifying the merger of these two entities with a shared mission of combating blindness globally.

HCP Cureblindness and SightLife International, both established eye health nonprofits, have a robust history of collaboration spanning 13 years. Their joint efforts have been focused on various initiatives, including clinical training, eye bank development, advocacy, and prevention programs in Nepal and Ethiopia.

The acquisition builds upon this longstanding partnership, allowing the consolidated organization to further amplify its impact and contribute significantly to the global efforts aimed at preventing and treating blindness.

9. Black Pearl's Acquisition of PolyDev, Ireland-Based Maker of Contact Lenses

.jpg)

Black Pearl Vision, recognized as the world's only Black-owned and woman-owned contact lens manufacturer, has concluded the acquisition of PolyDev. PolyDev, a distinguished Ireland-based manufacturer renowned for its specialty in color contact lenses, notably produces TORIColors, an exclusive molded opaque cosmetic contact lens tailored for individuals with astigmatism.

Following the acquisition, PolyDev will transition into operating as a subsidiary under the umbrella of Black Pearl Vision, symbolizing a strategic alignment of expertise and innovation in the realm of contact lens manufacturing. The acquisition includes PolyDev's state-of-the-art 2,500-square-foot facility situated in Dunleer, Ireland, bringing its cutting-edge technology and manufacturing capabilities into the expansive portfolio of Black Pearl Vision.

Click here to learn more about the Black Pearl Vision-PolyDev.

10. Vantage Acquires Ophthalmic Surgical Solutions

.jpg) Vantage Surgical Solutions has acquired Ophthalmic Surgical Solutions (OSS), a distinguished company based in Kansas that specializes in ophthalmic surgical equipment and services. This acquisition underscores Vantage Surgical Solutions' commitment to expanding its portfolio and offering comprehensive surgical solutions to meet the evolving needs of the ophthalmic surgery landscape.

Vantage Surgical Solutions has acquired Ophthalmic Surgical Solutions (OSS), a distinguished company based in Kansas that specializes in ophthalmic surgical equipment and services. This acquisition underscores Vantage Surgical Solutions' commitment to expanding its portfolio and offering comprehensive surgical solutions to meet the evolving needs of the ophthalmic surgery landscape.

Founded in 2015 and headquartered in Lecompton, Kansas, OSS brings a wealth of expertise and experience to the table, complementing Vantage Surgical Solutions' existing capabilities. The integration of OSS into Vantage Surgical Solutions' framework is anticipated to result in a dynamic synergy, enhancing the range of surgical solutions and services provided by the consolidated entity.

Navigating the Future

These top 10 acquisitions collectively reflect the ophthalmic industry's commitment to innovation, collaboration, and addressing the evolving needs of patients worldwide. As key players join forces and pool their resources, the stage is set for a new era of breakthroughs in ophthalmic research, development, and patient care.

(1).jpg)