FTC Allows Amgen to Acquire Horizon Therapeutics for $27.8B

Amgen is set to proceed with its acquisition of Horizon Therapeutics after reaching an agreement with the Federal Trade Commission (FTC). This agreement clears the way for Amgen to complete its acquisition of Horizon Therapeutics, a deal valued at $27.8 to $28 billion, making it one of the largest healthcare mergers.

The FTC had initially raised concerns about potential competitive harm resulting from the acquisition, leading to legal challenges. However, both parties have now come to terms, with the FTC accepting a binding settlement.

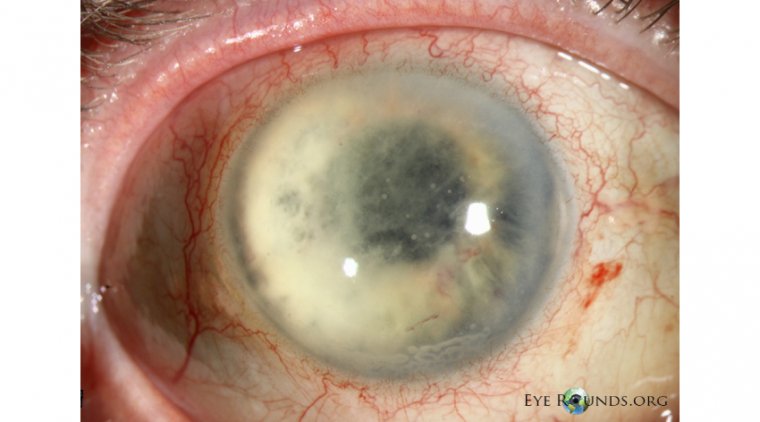

Under the proposed agreement, Amgen will face specific prohibitions and conditions. Firstly, Amgen will be prohibited from bundling any of its own products with Horizon's therapies, specifically, teprotumumab-trbw (Tepezza) for thyroid eye disease and pegloticase (Kyrtexxa) for gout treatment. Furthermore, Amgen is explicitly forbidden from linking any product rebates or contract terms related to its products to the sale or positioning of these two Horizon drugs, as outlined in the FTC statement.

Additionally, Amgen is barred from using product rebates to exclude or disadvantage any competing product. These measures aim to ensure fair competition and prevent anti-competitive practices in the pharmaceutical market.

"Consolidation in the pharmaceutical industry has given companies the power and incentive to engage in exclusionary rebating practices, which can lead to skyrocketing prices on essential medications," said Henry Liu, director of the bureau of competition at the FTC. "Today's proposed resolution sends a clear signal that the FTC and its state partners will scrutinize pharmaceutical mergers enabling such practices and defend patients and competition in this vital marketplace."

The proposed consent order effectively addresses both FTC and state allegations of anticompetitive implications arising from Amgen's acquisition of Horizon. This concern centers on Amgen potentially pressuring insurance companies and pharmacy benefit managers, leveraging its portfolio to favor Horizon's two monopoly products, Tepezza and Krystexxa, or disadvantage competitors offering alternatives.

Additionally, the proposed order restricts Amgen from entering agreements or arrangements for acquiring products related to thyroid eye disease (TED) or chronic refractory gout (CRG) without prior Commission approval. Amgen is also required to seek FTC approval for acquiring pre-commercial products completed through FDA clinical trials for TED or CRG treatment. These requirements remain in effect through 2032, and Amgen must notify the states when seeking Commission approval. These measures ensure compliance with the consent order's terms and deter potential anti-competitive practices.

Reference

https://www.ftc.gov/news-events/news/press-releases/2023/09/biopharmaceutical-giant-amgen-settle-ftc-state-challenges-its-horizon-therapeutics-acquisition

*Stay in the loop and make sure not to miss real-time breaking news about ophthalmology. Join our community by subscribing to OBN newsletter now.

(1).jpg)