Opthea’s Phase 3 COAST Trial for Wet AMD Fails to Meet Primary Endpoint

Opthea Limited has announced that its global Phase 3 clinical trial, known as COAST (Combination OPT-302 with Aflibercept Study), did not meet its primary endpoint for the treatment of wet age-related macular degeneration (AMD).

COAST Trial Design and Objectives

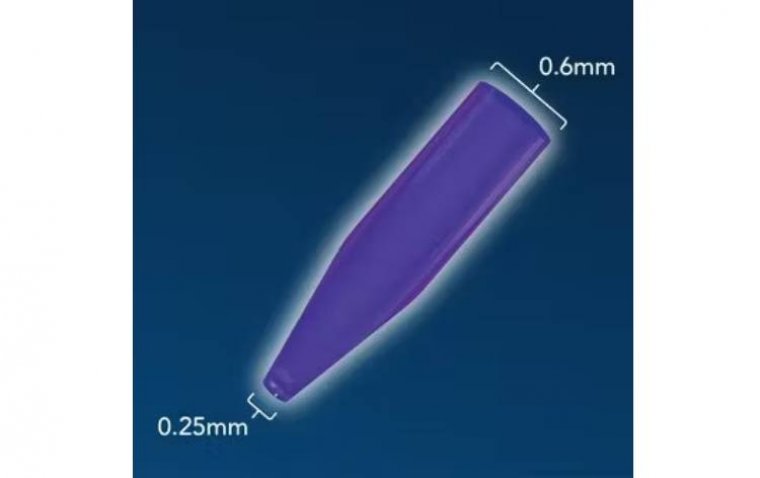

The COAST trial evaluated the efficacy and safety of sozinibercept—a first-in-class VEGF-C/D trap inhibitor—administered intravitreally at a dose of 2 mg every 4 or 8 weeks, in combination with aflibercept (2 mg) administered every 8 weeks, following a loading phase. The objective was to determine whether this combination therapy could deliver superior best corrected visual acuity (BCVA) improvements over aflibercept monotherapy.

Primary Endpoint Results

The primary endpoint, defined as mean change in BCVA from baseline to week 52, was not met. Among patients with minimally classic and occult lesions:

• Sozinibercept combination therapy administered every 4 weeks (n=296) or every 8 weeks (n=297) yielded a mean BCVA gain of 13.2 letters in both groups.

• This compared with 13.8 letters in the aflibercept monotherapy group (n=299), with P-values of 0.59 and 0.62, respectively.

In the overall population:

• Participants receiving combination therapy every 4 weeks (n=333) gained 13.5 letters.

• Those on the 8-week regimen (n=330) gained 12.8 letters.

• The aflibercept monotherapy group (n=330) gained 13.7 letters, with P-values of 0.86 and 0.42, respectively.

Secondary Endpoints and Safety Profile

Opthea reported no numerical differences in key secondary endpoints between treatment arms. Despite the lack of efficacy differentiation, sozinibercept combination therapy was well tolerated, with no safety concerns reported.

Opthea’s Response and Next Steps

Following the trial outcome, Opthea conducted a thorough review of the data to confirm its accuracy and integrity. According to the company, no anomalies were identified that would warrant an alternate interpretation of the trial results.

As of now, no decision has been made regarding the continuation of the COAST trial or the potential acceleration and unmasking of the parallel ShORe trial. Discussions are ongoing with Opthea’s Development Funding Agreement (DFA) investors to evaluate future strategies.

Financial Update and Trading Suspension

As of February 28, 2025, Opthea reported an unaudited cash and cash equivalents balance of $113.8 million. The company has requested that trading of its listed securities remain suspended on both the ASX and Nasdaq until an official announcement can be made, or until Monday, March 31, 2025, when trading will resume automatically.

(1).jpg)